Sponsor Ads

Non-China Vape, 510 Cartridges & Battery Device Maker

If you are going for a vape manufacturer out of China we are you best choice. We offer a alternative vape production location with a very competitive price. You can save money by buying directly from us the manufacturer, without any middlemen or extra fees. You can also enjoy discounts for bulk orders and special offers for long term & loyal customers.

We offer small trial orders where you can test the quality and performance of the products before placing a large order. Fast shipping and cheaper shipping cost from Malaysia and Singapore ports. You don't have to wait long to receive your products.

Contact Us!

Contribute for our website Maintenance! We want to keep it free for all visitors.

Trending Best Sellers

Chinese and Indian gold jewelry demand falling off a cliff

(Kitco News) - Investment demand will continue to drive gold prices even as physical sales in critical global markets have fallen off a cliff so far this year, according to one investment research group.

In a report Thursday, Alexander Kozul-Wright, a commodities economist at Capital Economics, highlighted dismal gold jewelry demand in China and India.

Quoting Chinese customs data, Kozul-Write, noted gold imports that imports fell by 50% year-over-year in the first two months 2020. Meanwhile, he added that withdrawals from Shanghai's gold exchange fell by 56% during the same period.

Looking ahead, Kozul-Write said that he doesn't expect to see a significant rebound in gold jewelry demand as gold prices remain high against the Chinese yuan and consumers remain subdued as the nation starts to recover from the COVID-19 pandemic.

"That said, China's gold imports may stage a comeback in the second half of the year, assuming that economic growth continues to gather pace and households start spending again," he added.

Kozul-Write is even more pessimistic about India's gold market. According to India's trade data, he said that gold imports last month fell by a whopping 73% m/m in March.

"It appears that inflated local-currency prices slashed jewelry demand in India's price-sensitive market," he said. "And with anecdotal evidence suggesting that domestic gold purchases ceased altogether after the government imposed a three-week lockdown on [March 24], India's gold imports could sink even lower in April."

Although gold jewelry demand is expected to be weak through 2020, Kozul-Write said that he expects investment demand to dictate gold prices this year. Currently, Capital Economics sees gold prices ending the year at $1,600 an ounce.

"In our view, the price of gold will only begin to fall once the global spread of COVID-19 is brought firmly under control," he said.

Last week, a $2.3 trillion loan program launched by the Federal Reserve -- to help small and medium-sized businesses impacted by the COVID-19 pandemic -- helped to push gold prices to a fresh seven-year high.

The precious metal is seeing some technical selling pressure at the start of the new week. June gold futures last traded at $1,734.50 an ounce, down 1% on the day.

News source & Original Author: By Neils Christensen For Kitco News

Comments

What you think?

Recent Articles

-

Riche Niche: Health | Lifestyle | Fashion | Marketing | Technology

Mar 14, 25 09:18 AM

Our Riche Niche blog is the easiest way to stay up-to-date with the latest news, trends and articles published on this site. -

The Therapeutic Potential of Medical Cannabis Vaporization

Aug 05, 24 09:32 PM

The use of medical cannabis has been a subject of much debate and research over the years. With the growing acceptance of cannabis for medical purposes, various methods of administration have been exp… -

Amazon Spring Sale: A Season of Spectacular Savings

Mar 18, 24 08:38 AM

Amazon Spring Sale: A Season of Spectacular Savings -

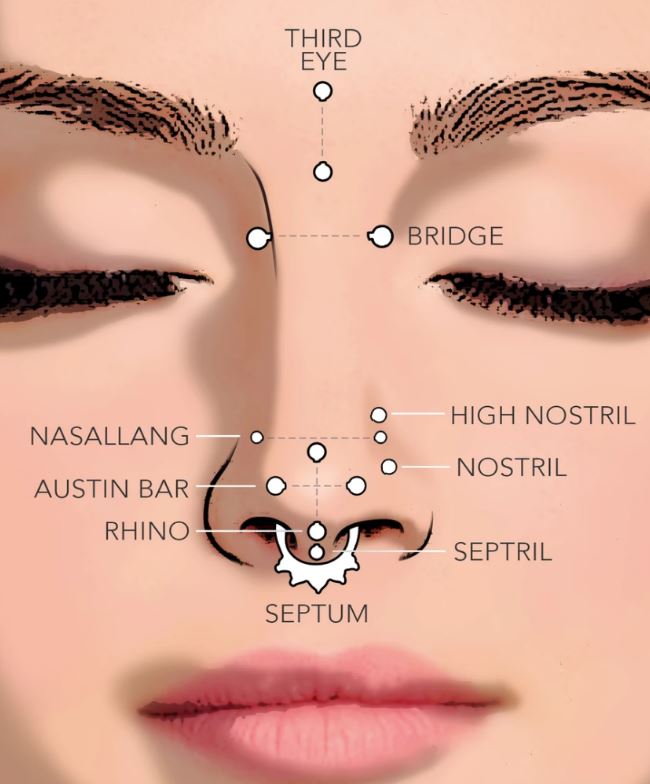

Understanding Nose Piercing Types: A Guide for Teens

Mar 16, 24 09:19 AM

Explore the rising trend of nose piercings among teenagers, understanding the various types and their cultural implications for a stylish appeal. -

Infected Nose Piercing

Mar 16, 24 09:18 AM

You can expect symptoms of infected nose piercing to resemble any other kind of body piercing infection. -

EMS manufacturing services in Malaysia

Mar 09, 24 10:33 PM

Malaysia is one of the leading countries in Southeast Asia that offers EMS manufacturing services to both local and international clients. -

Laundry Business: The Need for Payment System Upgrades

Mar 08, 24 11:14 AM

Discover the benefits of upgrading your laundry business's payment system. Enhance efficiency, increase profits, and improve customer convenience. -

Nose Peircing Store

Feb 18, 24 02:38 AM

A collection of latest at our nose peircing store. -

How to Choose the Right Coffee Maker for Your Needs

Feb 18, 24 02:12 AM

We'll compare the pros and cons of four common types of coffee makers: drip, French press, espresso, and vacuum. We'll also give you some tips on how to choose the right one based on your preferences… -

Emulate Celebrities with Nose Piercings

Feb 06, 24 08:13 AM

Discover the celebrities with nose piercing and get inspired for your next piercing! From studs to septum rings, our list has it all. Read more! -

Types of Nose Rings

Feb 06, 24 08:11 AM

Types of Nose Rings -

Is my nose piercing ring is sinking in?

Feb 06, 24 08:10 AM

Is my nose piercing ring is sinking in? Or just swollen? -

Dry Herb Vape Pens-Discover the Advantages of Malaysian Made

Feb 04, 24 12:39 PM

Choose our non-China dry herb vape pen for its high production standards, strict quality control, and excellent craftsmanship. -

Trinity Nose Ring A Unique Fashion Statement

Feb 03, 24 08:36 PM

Explore the world of trinity nose rings, a unique piece of jewelry that adds elegance and style to your look. Understand the different types and choose the right one for you. -

Redefining Beauty: The Rise of Nose Piercing Trend in the USA

Feb 02, 24 08:34 AM

Explore the evolution of the nose piercing trend in the USA, from ancient tradition to modern expression of individuality.