Sponsor Ads

Non-China Vape, 510 Cartridges & Battery Device Maker

If you are going for a vape manufacturer out of China we are you best choice. We offer a alternative vape production location with a very competitive price. You can save money by buying directly from us the manufacturer, without any middlemen or extra fees. You can also enjoy discounts for bulk orders and special offers for long term & loyal customers.

We offer small trial orders where you can test the quality and performance of the products before placing a large order. Fast shipping and cheaper shipping cost from Malaysia and Singapore ports. You don't have to wait long to receive your products.

Contact Us!

Contribute for our website Maintenance! We want to keep it free for all visitors.

Trending Best Sellers

Cheap Car Insurance- Don't miss out your savings!

Trending Best Sellers

Trending Best Sellers

Cheap car insurance? Practically there is no "cheap" car insurance company but, it all depends on what you want! Part of the problem is deciding just what "cheap" means. Cheapest premium for lesser pay out/claims? To find the right auto insurance, start by figuring out the amount of coverage you need. This varies from state to state, so take a moment to find out what coverage is required where you live. You will find a list of each state's requirements and an explanation of the various types of insurance. Also, check out important car Insurance Issues, which has a glossary of basic insurance terminology. If you're a first-time driver and need a comprehensive overview of car insurance before you go on, review this guide from the National Association of Insurance Commissioners.

Ask these questions before deciding on which company to chose. Is the company pay claims quickly? Strong financials? Least number of policyholder complaints? Or what? Whatever your criteria, the answer tells you what company is best for you. Now you're ready to make a list of the different types of coverage you are considering.

Only 7 car insurance companies make up 65% in United States they are Allstate, Farmers, Geico, Liberty Mutual, Progressive and State Farm, which are accessible to anybody, and USAA.

4 ways you can find the cheap car insurance

1. Do some search online to learn about the car insurance in your state as every state has its own rules on car insurance coverage.

2. Check their financial rating of the insurance company in your state’s department. State department will definitely have a list of their most trusted companies in their official website.

3. Check and read online reviews from other clients as online review sites offer fair reviews for different insurance companies.

4. Do some online car insurance calculator and compare the rates from different car insurance companies to get the best value for your money.

Cheap car insurance thought about statements from these safety net providers in ZIP codes the nation over. Rates are for strategies that incorporate obligation, impact, far reaching, and uninsured/under insured driver inclusions, just as some other inclusion required in each state.

The least expensive vehicle protection, period, will probably convey the base inclusion required in your state. In many states, this is obligation protection just, which covers property harm and doctor's visit expenses for others because of mishaps you cause. A few states likewise require uninsured and under insured driver inclusion, which pay for your wounds or harm if a to blame driver needs more protection.

Arrangements with far reaching and impact inclusion are pricier, yet spread you in the event that your vehicle is taken or harmed, regardless of who (for sure) caused it. At the point when you add these to obligation and uninsured/under insured inclusions, it's normally thought to be full inclusion.

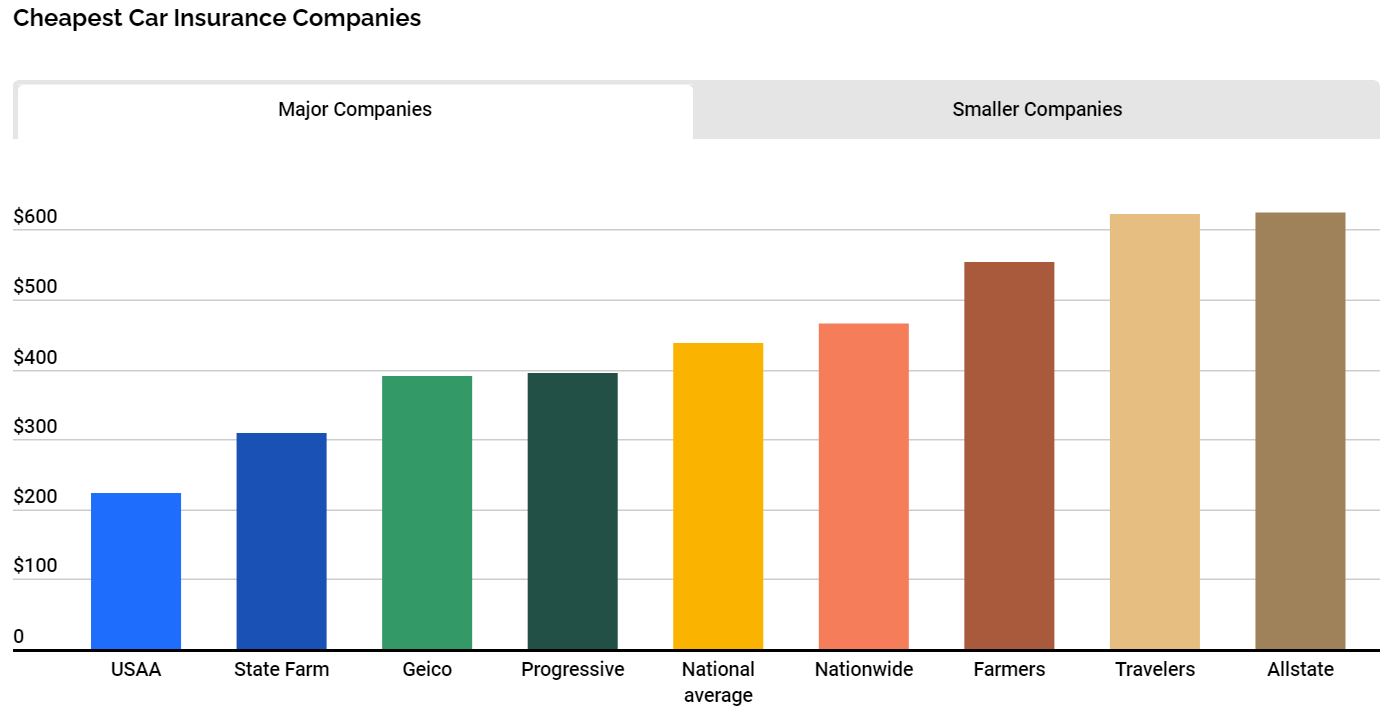

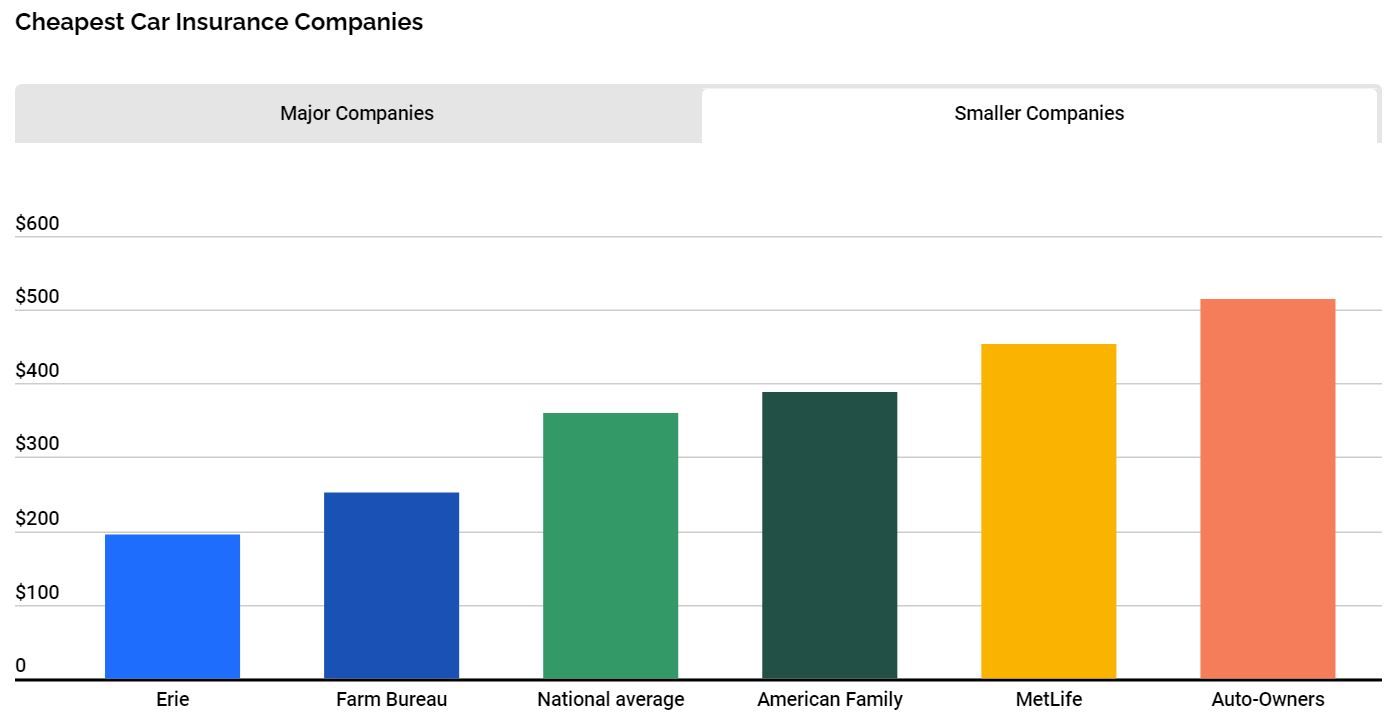

The Cheapest Car Insurance Companies (May 2021)

Additional Details for cheap car insurance

The cheap car insurance companies

The cheap car insurance companies by state

What is the cheap car insurance for you?

ow to get the right amount of cheap car insurance

Car insurance also known as vehicle insurance, motor insurance, or auto insurance is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Car insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region.

Common Car Insurance coverages

Comprehensive

Also known as “other than collision,” this coverage can help pay for damage to your vehicle from vandalism, theft, weather events and accidents involving animals.

Collision

Regardless of who’s at fault, collision can pay for damage to your vehicle if you hit another vehicle or object, another vehicle hits you, or your vehicle rolls over.

Gap coverage

Gap insurance may help you cover the “gap” between what you owe on your car and your car’s actual cash value.

Uninsured motorist

If an uninsured or underinsured driver causes an accident that results in property damage and/or bodily injury, uninsured motorist coverage may help pay for damage and medical costs for you and your passenger(s).

Bodily injury liability

If you cause an automobile accident that results in injuries, bodily injury protects you by paying for damages you may become legally liable for as a result of the accident, including medical bills and loss of income for the injured party.

Roadside Assistance

Roadside Assistance coverage may even be available when you and your family household members are passengers in someone else's vehicle, or during a roadside emergency in which your vehicle is disabled.

The most common types of car insurance

There are six main types of cheap car insurance coverages that are available when you purchase a policy, which include:

Bodily injury liability

Medical payments or personal injury protection (PIP)

Property damage liability

Collision

Comprehensive

Uninsured and underinsured motorist coverage

How are auto insurance premiums calculated?

https://www.insurance.com/auto-insurance/coverage/auto-insurance-coverage-calculator.html

New quoting software is very sophisticated and can include hundreds of variables. The most heavily weighted as you might guess include the type of vehicle and which features are included in your model, driving and claims history, insurance payment history and the distance you drive annually.

Beyond those basic factors every carrier is different so it’s a matter of finding the one that’s a good fit for you any given year.

Premiums are calculated on the basis of three basic factors namely:

The Insured Declared Value (IDV)

Cubic capacity of the vehicle

Age of the vehicle

It is important to note here that the calculation of IDV or the insured declared value is only meant for a comprehensive insurance policy and not third-party insurance cover.

In cases where the vehicle is older than 5 years, the owner of the vehicle and the insurance company will mutually arrive at a valuation of the vehicle after considering its depreciation and its present condition.

However, if you are looking for a third-party policy, the insurance premium will depend on the size of the engine.

What are good ways to get cheap car insurance?

Raise your deductibles for collision and other than collision coverages.

That’s the fastest way and will have the greatest impact.

The downside is that you will have to cough up extra money in the event of a loss, but that should be an unlikely occurrence anyway.

You could also just check with your agent to make sure that you are taking advantage of all potential discounts (multi-policy, security system, roof age, etc.)

Outside of that, you would have to reduce your limits/coverage. That should only be a last resort measure and probably isn’t worth the small cost savings. You should also speak with a licensed insurance agent prior to doing anything like that as well.

Much like trying to secure a higher salary at your current job vs. moving to a different company, any major change is only coming if you switch companies.

10 Ways In Which A Driver Can get Cheap Car Insurance

For cheap car insurance, check our website for free auto insurance quotes online.

- Make sure all your cars are on the same policy. All insurers offer a “Multi-vehicle discount” for customers who insure more than one vehicle on the same policy. This can bring you consistent savings on all cars.

- Insure your car and home with the same company. It is perfectly legal and it is also a great way to benefit of another discount.

- Increase your deductibles. Raising your deductibles will lower your insurance premiums. Insurance was really meant to cover you for damages you could never afford on your own, so by agreeing to spend more from your own pocket, the insurer will ask for less money.

- Think about dropping your collision coverage if you have an older car. If your car is getting up there in age, you may want to think about dropping the collision coverage on your policy since the rates for this plan increase drastically with the age of the car.

- Maintain a clean driving history. Your driving record is one of the most influential factors in determining your insurance rate. Keep it clean and you will get good rates.

- Drive a safe car. Insurance rates for cars are based on the previous claims history for that vehicle and statistics. The more likely a car is to be stolen or to be involved in an accident, the more you pay for insurance.

- If you are a new driver, you should take a driver’s training course. Licensed drivers who have completed an approved driver training course in the last 3 years pay lower premiums. Safer drivers pay lower insurance rates.

- Have an anti-theft devices and safety devices installed on your car. Insurance companies provide hefty discounts to those who invest in their car security and safety. If you already have an approved, factory-installed alarm in your car, we will take this into account when determining your rate.

- Make periodic checks of the market. Many of your personal, professional and driving details change all the time, and so will the way auto insurance companies consider you. If you don’t compare insurance rates at least once or twice a year, you’ll never know if you could be paying less. Shop for auto insurance using online car insurance quotes.

- Pay premiums annually, not monthly. Additional administrative fees are commonly applied to payments when you choose to pay premiums monthly.

We know that having insurance is a good thing, but we don’t always want to pay the premium. Insurance can be costly and most drivers view themselves as safe drivers. We don’t expect anything bad to happen so we avoid paying the extra cash for insurance.

The reality of the situation is that sooner or later we will all be in some kind of accident. We may get away with many situations in which we could have purchased insurance but we didn’t. This gives us the feeling that we don’t actually need the insurance because nothing bad ever happens.

It only takes one accident to overtake all the savings you’ve accrued skipping out on insurance in the past. Get into the habit of opting into insurance and you never have to worry about making a critical error in the future.

Just because of you opt-in for insurance whenever you can, doesn’t mean you have to pay full price.

Sources

https://en.wikipedia.org/wiki/Vehicle_insurance_in_the_United_States

https://www.forbes.com/advisor/car-insurance/best-car-insurance-companies/

https://www.nationwide.com/personal/insurance/auto/

https://compare-autoinsurance.org/10-ways-in-which-a-driver-can-save-for-car-insurance/

https://www.bankrate.com/insurance/car/coverage-types/

https://www.insurance.com/auto-insurance/coverage/auto-insurance-coverage-calculator.html

To the Top of this page Cheap Car Insurance.

Other Related Pages

Los Angeles Car Accident Lawyer

Comments

What you think?

Recent Articles

-

Riche Niche: Health | Lifestyle | Fashion | Marketing | Technology

Mar 14, 25 09:18 AM

Our Riche Niche blog is the easiest way to stay up-to-date with the latest news, trends and articles published on this site. -

The Therapeutic Potential of Medical Cannabis Vaporization

Aug 05, 24 09:32 PM

The use of medical cannabis has been a subject of much debate and research over the years. With the growing acceptance of cannabis for medical purposes, various methods of administration have been exp… -

Amazon Spring Sale: A Season of Spectacular Savings

Mar 18, 24 08:38 AM

Amazon Spring Sale: A Season of Spectacular Savings -

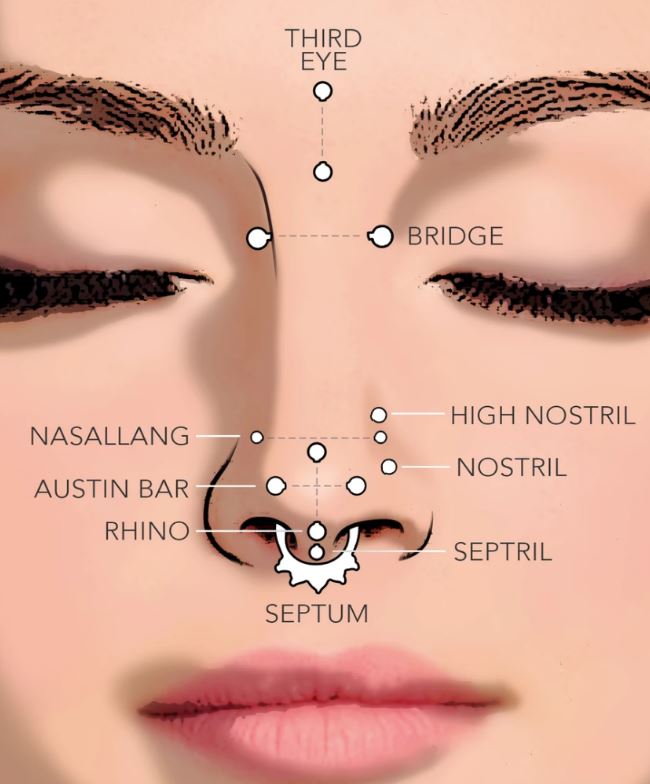

Understanding Nose Piercing Types: A Guide for Teens

Mar 16, 24 09:19 AM

Explore the rising trend of nose piercings among teenagers, understanding the various types and their cultural implications for a stylish appeal. -

Infected Nose Piercing

Mar 16, 24 09:18 AM

You can expect symptoms of infected nose piercing to resemble any other kind of body piercing infection. -

EMS manufacturing services in Malaysia

Mar 09, 24 10:33 PM

Malaysia is one of the leading countries in Southeast Asia that offers EMS manufacturing services to both local and international clients. -

Laundry Business: The Need for Payment System Upgrades

Mar 08, 24 11:14 AM

Discover the benefits of upgrading your laundry business's payment system. Enhance efficiency, increase profits, and improve customer convenience. -

Nose Peircing Store

Feb 18, 24 02:38 AM

A collection of latest at our nose peircing store. -

How to Choose the Right Coffee Maker for Your Needs

Feb 18, 24 02:12 AM

We'll compare the pros and cons of four common types of coffee makers: drip, French press, espresso, and vacuum. We'll also give you some tips on how to choose the right one based on your preferences… -

Emulate Celebrities with Nose Piercings

Feb 06, 24 08:13 AM

Discover the celebrities with nose piercing and get inspired for your next piercing! From studs to septum rings, our list has it all. Read more! -

Types of Nose Rings

Feb 06, 24 08:11 AM

Types of Nose Rings -

Is my nose piercing ring is sinking in?

Feb 06, 24 08:10 AM

Is my nose piercing ring is sinking in? Or just swollen? -

Dry Herb Vape Pens-Discover the Advantages of Malaysian Made

Feb 04, 24 12:39 PM

Choose our non-China dry herb vape pen for its high production standards, strict quality control, and excellent craftsmanship. -

Trinity Nose Ring A Unique Fashion Statement

Feb 03, 24 08:36 PM

Explore the world of trinity nose rings, a unique piece of jewelry that adds elegance and style to your look. Understand the different types and choose the right one for you. -

Redefining Beauty: The Rise of Nose Piercing Trend in the USA

Feb 02, 24 08:34 AM

Explore the evolution of the nose piercing trend in the USA, from ancient tradition to modern expression of individuality.